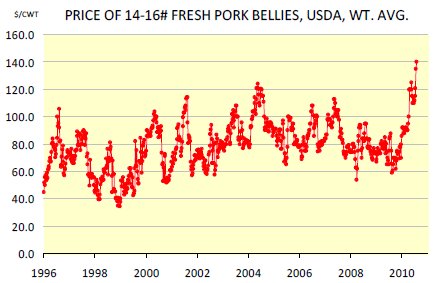

On Monday, USDA printed the price of fresh pork bellies traded in the spot market (all weight ranges) at $140 /cwt, the highest prices since at least 1996, when USDA began tracking the current weight ranges and likely the highest price ever paid for fresh or frozen pork bellies. It is kind of interesting that belly prices are now trading some 18 cents over the price of pork loins.

There was a time when lean was the name of the game as the industry was trying hard to beat chicken and the other white meat phrase was born. At least at the moment the consumer is opting for more flavor and those crisp slices of fatty pork sure fit the bill.

The rise in the price of pork bellies is partly seasonal. Much of the commentary in the press mentioned the high use of bacon in the summer for BLT sandwiches. Also there is the proliferation in the use of bacon as a flavor enhancer in the foodservice industry, with many chicken and hamburger sandwiches getting a slice or two of bacon for good measure.

These are arguments that we heard in the summer of 2004 as well and they reflect some of the fundamentals driving the belly market at this time of year. What they do not explain is what makes 2010 so different from other years. Consumers did not discover BLT sandwiches in the summer of 2010 and bacon has been burrowing its way in the menus of high end and fast food restaurants for almost a decade.

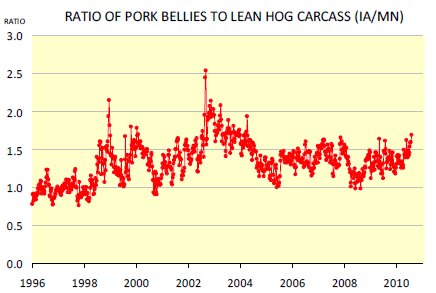

Part of the reason is the price of hogs. While pork belly prices are sky high as the top chart shows, the ratio of pork bellies to the price of hogs (i.e. the relative price of the two) shows only modest variations in the last five years (bottom chart). Indeed, in this respect the summer of 2003 and 2004 appears much more impressive since belly prices at the time rose much faster than the price of hogs. With hog prices in the mid 80s, bellies at 120-140 actually do not seem that crazy. Another factor influencing belly prices this summer is the behavior of end users coming into the high demand time of year. End users, be this retailers or foodservice operators, have always recognised the pick up in demand for bellies during the summer, as evidenced by the normal buildup in belly freezer stocks during the spring. Hog production is down in the summer while belly demand is up and users smooth out some of the price spikes by carrying over some winter and spring stocks.

Last year, however, the strategy did not seem to work and belly prices collapsed into the summer with prices in July at about the same level as in March and then sharply lower in August. This year end users trimmed inventories, partly because of very high hog prices in the spring. On 1 June, freezer stocks were half of what they were the previous year. Pork production last week was 6.8 per cent lower than a year ago and with freezers empty, end users are forced to pay top dollar for that additional spot load.