Financial figures mentioned in this release are adapted from the unaudited financial statements for the third quarter of 2010 prepared in accordance with PRC corporate accounting standards.

China Oilfield Services Limited COSL or the Company announced its unaudited results for the nine months ended 30 September 2010.

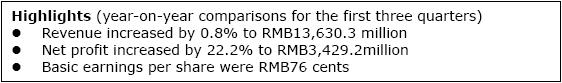

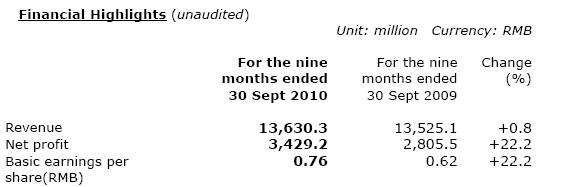

Revenue for the nine-month period was RMB13,630.3 million, up 0.8% from RMB13,525.1 million in the last corresponding period Due to cancellation of a service contract for a semi-submersible drilling rig under construction in the last corresponding period, the Company has wrote back RMB1,073.1 million in related deferred income. Stripping out effect of this, revenue for the period should have increased 9.5% year on year . Net profit for the period was RMB3,429.2 million, up 22.2% from the last corresponding period. Basic earnings per share were RMB76 cents, up RMB14 cents from the last corresponding period.

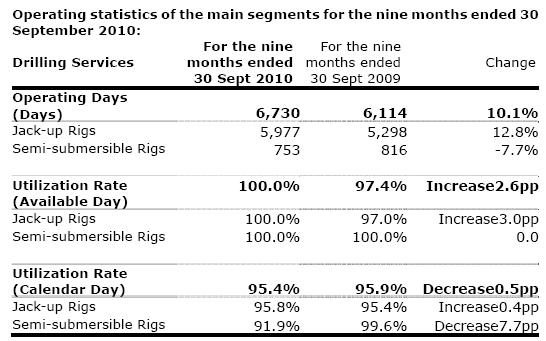

On drilling services, a total of 6,730 operating days were achieved by the Company s drilling fleet during the nine-month period, up 616 days year on year. The increase was driven by commencement of operation of two new jack-ups COSL936/COSL937 , which added 506 operating days. In addition, CDE saw an improvement in its operating efficiency. The two new jack-ups which commenced operations last year operated in full during the nine-month period under review, adding another 345 operating days. However, an increase in number of vessels undergoing maintenance during the period reduced 235 operating days.

The four module rigs operating in Mexico continued their normal operations during the period and achieved 1,084 operating days, representing a calendar day utilization rate of 99.3%. The 6 land rigs operating in Libya and domestic markets in China achieved 1,575 operating days during the period, representing a calendar day utilization rate of 96.2%.

Revenue for the well services segment reported an increase from the last corresponding period due to new business development and increase in operation volume.

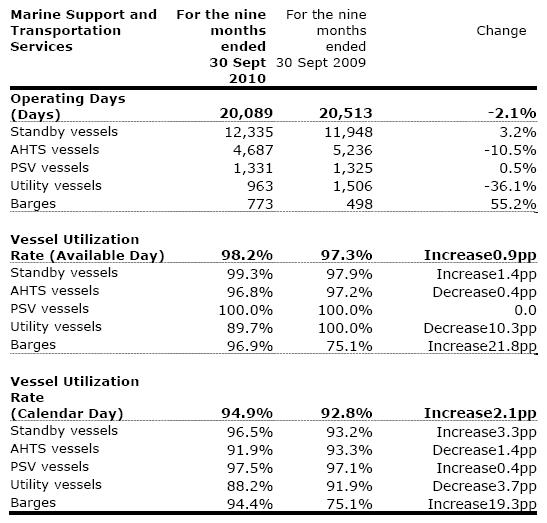

On marine support and transportation services, a total of 20,089 operating days were achieved during the nine-month period, down 424 days year on year due to writing-off of vessels expired since the third quarter last year. Under such impact, anchor handling tug supply vessels and utility vessels therefore reduced 1,092 operating days. Offshore standby vessels and well workover supporting barges achieved 662 more operating days. Platform supply vessels operated 6 more days due to reduced time spent in maintenance.

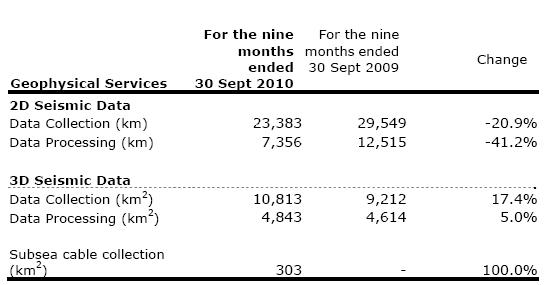

In geophysical services, as a 2D seismic vessel has been rebuilt into a streamer vessel and a reduction in demand for 2D seismic data collection, the volume of 2D seismic data collection dropped 20.9% year on year. The volume of 2D seismic data processed reduced accordingly. Propelled by the overseas operations of COSL719, the volume of 3D seismic data collected increased 17.4% year on year to 10,813 sq.km. The volume of 3D data processed increased steadily at 5.0% year on year.The newly launched subsea cable collection business achieved an operation volume of 303 sq.km. during the nine-month period.

Mr. Li Yong, CEO and president of the Company, said: While the world economy continues to recover, there still exist significant downside risks. The oilfield service industry is recovering slowly. There is still very stiff competition in utilization of large scale equipment. In light of this complex economic environment, COSL will continue to exploit its potential and grasp every opportunity in the market and intensify its expansion efforts into domestic and overseas markets. COSL endeavors to drive the ongoing development of its major business segments to create stable return for shareholders.

Related News

Photos

More>>trade

market

finance

- XCMG Construction Machinery Holds a Customer Summit at Bauma China 2010

- XCMG 1000-tonnage Products Sweep across the Bauma China 2010

- XCMG s XGC28000 crawler crane became landmark product in Bauma Shanghai

- Skyscraper safe guardia: XCMG s 88-meter fire truck launched in Bauma

- XCMG leads technical development of China earthmoving machinery products to