Friday saw a quiet and lackluster trading session. Early NYF was generally holding firm supported by the overall commodities markets. Overnight ICE opened at around unchanged amid mixed actions in the grains market and the crude oil price.

It then steadily traded higher in expectation of strength coming from the grains re-open. Crude oil was yet again trading at $118 based on fundamental news, right after the temporary pull back earlier this week.

Cotton was trading at slight gain before seeing strength in the dollar and cool off in the grains. N’08 settled at 71.44 or 69 points lower by end of the session. Today’s total May contract notices were posted at 78.

The commitment of traders supplementary report published by CFTC on Friday shows that as of Tuesday April 22nd, for futures and options combined positions, the commercials had increased their long positions by 800 contracts and reduced their short positions by 1,500.

The non commercials reduced their longs by 500 contracts and their shorts by 1,600 contracts, thus increased their net longs by 1,100. Index traders had liquated their net long positions by nearly 800 contracts. In the meantime, total open interest dropped around 6,000 contracts during the week.

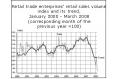

The false breakout on April 16th, which tested the high of 82 cents basis N’08 was followed by profit taking sell off, thus negative technical pictures for the past sessions. N’08 has been range trading and tested the short term support level at 71.25, which was touched on March 20th.

The strong lead cotton receives from the outside commodities markets, or the CRB index, as well as the tight inverse relationship between cotton and dollar index are the rationales that have supported the recent market movement.

The cotton market feels like we could move sideways short term with more down side testing in the future. The next support lies in the mid 70 cent range.

It then steadily traded higher in expectation of strength coming from the grains re-open. Crude oil was yet again trading at $118 based on fundamental news, right after the temporary pull back earlier this week.

Cotton was trading at slight gain before seeing strength in the dollar and cool off in the grains. N’08 settled at 71.44 or 69 points lower by end of the session. Today’s total May contract notices were posted at 78.

The commitment of traders supplementary report published by CFTC on Friday shows that as of Tuesday April 22nd, for futures and options combined positions, the commercials had increased their long positions by 800 contracts and reduced their short positions by 1,500.

The non commercials reduced their longs by 500 contracts and their shorts by 1,600 contracts, thus increased their net longs by 1,100. Index traders had liquated their net long positions by nearly 800 contracts. In the meantime, total open interest dropped around 6,000 contracts during the week.

The false breakout on April 16th, which tested the high of 82 cents basis N’08 was followed by profit taking sell off, thus negative technical pictures for the past sessions. N’08 has been range trading and tested the short term support level at 71.25, which was touched on March 20th.

The strong lead cotton receives from the outside commodities markets, or the CRB index, as well as the tight inverse relationship between cotton and dollar index are the rationales that have supported the recent market movement.

The cotton market feels like we could move sideways short term with more down side testing in the future. The next support lies in the mid 70 cent range.

Related News

Photos

More>>trade

market

finance

- Germany:'Seamless Smart' machine gives major boost to hosiery market

- USA:DuPont launches certified fire & chemical protection garment

- Germany:Symposiums conducted on advances & innovations in textiles

- India:Soaring cotton prices hamper industry's performance

- Germany:Business better in long & extra long staple cotton