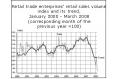

The Textiles trade bodies and associations have represented that the appreciation of the rupee vis-à-vis US dollar during 2007, has adversely affected the exports of textiles and clothing from India.

However, trade statistics available for the period April-December, 2007 indicate that the overall exports at USD 14935.69 million in this period denotes an increase of 9.33% in US dollar terms, over the corresponding period of 2006-07, though in rupee terms, the exports at Rs.60351.09 crore represent a small decline of 2.9% over the corresponding period of 2006-07, due to the aforesaid weak position of the dollar.

As per estimates made by Confederation of Indian Textile Industry (CITI), for every export loss of rupee one crore, there would be a job loss of 34-35 workers. However, no physical quantification of actual job losses, on account of appreciation of the rupee, has been made by CITI.

The Government has announced several relief measures to support the textiles industry, which has been representing that textile exports have been affected by the appreciation of the value of rupee vis-a-vis the US Dollar.

These measures include the following:-

(i) DEPB rates enhanced by 3% for 9 sectors including textiles (also handlooms), RMGs and handicrafts. For other items, DEPB rates enhanced by 2%.

(ii) ECGC premium reduced by 10%.

(iii) Amount of Rs.600 crore released for clearing arrears of CST reimbursement and terminal excise duty.

(iv) Duty drawback rates enhanced by 10-40% of the existing rates.

(v) Subvention on credit rate allowed upto 4% including interest subsidy of 2%.

(vi) Refund of service tax paid by exporters on services linked to export of goods viz port services for exports, transport of goods by road from container depot to port of export, general insurance services for insurance of goods for export, technical testing and analysis agency services and inspection and certification services, storage & warehousing services and clearing activity services.

(vii) Customs duty on intermediates for Polyester staple fibre and polyester filament yarn reduced from 7.5% to 5%.

(viii)Customs duty on paraxylene, a raw material for the intermediate PTA reduced from 2% to 0%.

(ix) Customs duty reduced on other man-made filament yarn & staple fibres of acrylic & viscose from 10% to 5%.

(x) Customs duty reduced on spun yarn of man-made staple fibres & filament yarn (other than nylon) from 10% to 5%.

(xi) Customs duty reduced on polyester chips from 7.5% to 5%.

This information was given by the Minister of State for Textiles, Shri E.V.K.S. Elangovan in a written reply in the Rajya Sabha.

Related News

Photos

More>>trade

market

- France:Worldwide Textile Rendez-vous to take place in Paris Le Bourget

- Special Underwear Show in Singapore

- USA:Dov Charney of American Apparel named Retailer of the Year

- 7th Annual Tulips & Pansies: The Headdress Affair in New York

- Germany:'Seamless Smart' machine gives major boost to hosiery market

finance

- USA:DuPont launches certified fire & chemical protection garment

- Germany:Symposiums conducted on advances & innovations in textiles

- India:Soaring cotton prices hamper industry's performance

- Germany:Business better in long & extra long staple cotton

- Thailand:Workshop on development of technology & traditions of silk