NY futures fell precipitously since our last report two weeks ago, with July dropping 603 points to close at 69.25 cents, while December lost 586 points to close at 77.45cents.

After successfully fending off the bears on previous attempts, the bulls were no longer able to hold important long-term support today and values caved in due to a broad-based sell-off in the commodity complex.

Even though the July contract had already violated its eleven-and-a-half-month uptrend line a week ago, December had so far been able to hold above it, but today it closed below this important trendline as well. This breach of major support may lead to further weakness over the coming sessions, as spec longs will probably reduce some of their holdings, while spec shorts may use it as a trigger point to sell the market.

Earlier today things looked rather promising, not only because July rebounded quite strongly off of Wednesday's lows, but we were also treated to a much better than expected export sales report of a combined 738'300 bales. The report showed widespread buying activity, as no less than 20 different markets were listed, with China taking over 430'000 bales.

The only spoiler was the slow pace of shipments, as they amounted to only 197'500 running bales, raising fears that ending stocks may indeed be surpassing 10.0 mio bales by the end of July. However, while this number may weigh on traders' minds from a psychological point of view, we should not forget that total supply in the US next season will probably be the lowest in 5 seasons, assuming a crop size of just 14-15 mio bales.

There is a lot of talk these days that the commodity bubble has burst and that prices are headed for a considerable decline in the months ahead. While the commodity complex as a whole may undergo a severe correction, there will be widely differing performances among the various commodities and we need to be careful not to throw the baby out with the bathwater.

The dynamics for other commodity are different because of its increased use for ethanol, which constantly adds demand that may actually outstrip production.

So where does cotton fit in? First of all, even though the price of cotton is higher than it was in the previous 4 years, it is by no means expensive by historical standards. When we look at a 30-year chart, we notice that spot cotton is just about at its long-term average price.

In other words, cotton has never taken off like its competitors in the grain markets and it should therefore not get punished as hard if some of these high-flyers correct.

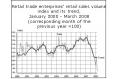

When we look at the drivers behind today's commodity prices, we still have to a large degree the traditional supply/demand factors, but in recent years there has been a noticeable increase in spec participation, particularly from index funds. These securitized investment products have driven up open interest much beyond historical norms and have put a permanent bid under the market.

These long-only, fully collateralized positions need to be viewed as longer term investments which depend entirely on money flows from their investors, such as pension funds, insurance funds and retail clients. Until now we have seen these investments grow and there is no reason to believe that this is changing anytime soon, quite to the contrary.

Related News

Photos

More>>trade

market

finance

- Germany:'Seamless Smart' machine gives major boost to hosiery market

- USA:DuPont launches certified fire & chemical protection garment

- Germany:Symposiums conducted on advances & innovations in textiles

- India:Soaring cotton prices hamper industry's performance

- Germany:Business better in long & extra long staple cotton