Bear market may continue on government tightening measures

SHANGHAI - Mainland stocks fell for the first time in three days, led by developers and commodity producers, on concern the government will step up tightening measures after property prices rose at the second-fastest pace on record.

An investor watches share prices at a brokerage in Haikou, Hainan province. [SHI YAN / FOR CHINA DAILY]

China Vanke Co paced declines among developers after housing prices advanced 12.4 percent in May. Jiangxi Copper Co led miners lower as copper, aluminum and zinc dropped. Baoshan Iron & Steel Co retreated 1.9 percent after Citigroup Inc lowered its price estimate on the shares.

"Unless there is a double dip in the global economy, the government is likely to maintain a tight policy on the property industry," said Christina Chung, senior portfolio manager at RCM, which oversees $146 billion in assets worldwide. "The correction in property stocks may take a longer time to play out."

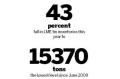

The Shanghai Composite Index fell 21.29, or 0.8 percent, to close at 2,562.58. The CSI 300 Index declined 1.2 percent to 2,750.02.

China Vanke lost 2.1 percent to 7.15 yuan ($1.05). Gemdale Corp slid 3.3 percent to 6.76 yuan, paring Wednesday's 5.9 percent advance. A measure of property stocks fell 1.7 percent on the Shanghai Composite on Thursday, the biggest drop among the five industry groups, and capping a 29 percent slump this year.

Commercial and residential property prices in 70 cities home prices rose 12.4 percent in May from a year earlier, the statistics bureau said on Thursday. That was down from a record 12.8 percent in April. Sales value fell 25 percent last month from April.

'Bear market'

Manop Sangiambut, head of China A-share research at CLSA Asia-Pacific Markets, said that the introduction of index-futures trading has contributed to recent declines."We are still in a bear market," said Zhang Ling, a fund manager at Shanghai River Fund Management Co. "Given the outlook of the economic data, the government isn't likely to relax its current tightening measures now. Any jump on the index is a bear-market rally."

Hang Seng gains

Hong Kong's benchmark stock index rose, as a surge in mainland exports overshadowed a drop in developers on concern mainland will step up tightening measures.

The Hang Seng Index advanced 0.1 percent to close at 19,632.70. The Hang Seng China Enterprises Index of mainland companies' H-shares gained 0.1 percent to 11,178.17.

Bloomberg News