|

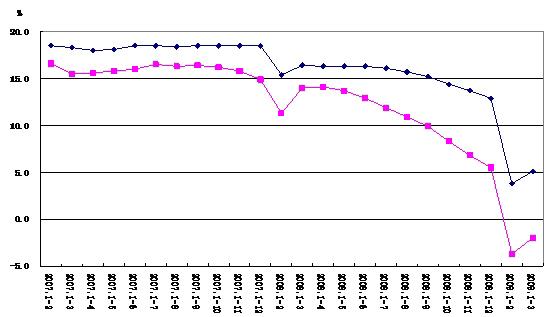

Q:I think you must have noticed the article of 15 May 2009 on the Wall Street Journal with regard to the report made by an international agency which casts doubt on China s economic data. A: Yes, we have. And we have carefully read the original text on the international agency s report. To my regret, the views expressed on the original lack evidence and some views are the conclusions made by private consulting services. We believe that it is not serious for an international agency to do it this way. Q: Why do you think it lacks evidence then? A: The original text thinks that China s reported 1Q09 GDP growth does not tally with oil demand data, nor with electricity demand. This kind of comparison makes problems. Taking comparison between the entire economic growth and part of energy consumption growth may lead to a mistake that one may have made by comparing the whole with its part. The fact is that the 1Q09 GDP growth was 6.1% while the energy consumption grew by 3.0%. They both developed with a same direction and did not have the problem of inconsistency. Q: Can you give some further details? A: We observed a positive economic growth with a negative electricity use. We think that there are two elements to explain it. The first one was a big change in the industrial structure in 1Q09 due to a rapid growth of the tertiary sector, a sector that usually has less consumption of electricity. The tertiary sector made a year-on-year growth of 7.4%, 2.1 percentage points higher than the secondary sector, and its contribution to the GDP grew from 42.7% a year earlier to 44.3%, already overtaking the industrial sector. By contrast, the value added of the industrial sector contributed 46.0% in 1Q08 down to 44.1% in 1Q09. A: The second was that the production and electricity use of energy-intensive industries slowed down while less-energy-consuming high-tech industries grew at a faster pace. In the first quarter, the six most energy-intensive industries which consumed 63% of the electricity used by all industrial firms at cut-off size and above had their value added up by 2.3% year-on-year, or 12.5 percentage points less than a year earlier. However, its electricity use in 1Q09 dropped to -3.7% from 13.2% growth in 1Q08, and its drop was 1.1 percentage points greater than all industrial firms at and above cut-off size. Examples in the first quarter include the information chemical manufacturing up by 15.5% year-on-year, chemical medicine manufacturing up by 14.0%, biological and biochemical manufacturing up by 17.2%, communication and exchange equipment manufacturing up by 34.7%, and medical equipment and devices manufacturing up by 11.0%, all of which achieved a faster growth than the one of 5.1% for all the industrial firms at and above the cut-off size in terms of value added. A:Another good example is the consistency of the trends of the economic growth and electricity use (generation) though the economy had a positive growth and electricity use had a negative one. From January 2008 to February 2009, the value added of the industrial sector at and above cut-off size kept slowing down while the electricity generated had a similar direction; however, the value added picked up from January to March 2009 and so did the electricity generated. Value Added of Industrial Sector at and above Cut-off Size vs. Electricity Generated (Accumulated Terms) Blue: Value AddedPink: Electricity Q: Have any other countries experienced such differences in economic growth with electricity use? A: Yes. The US electricity use dropped by 3.6% in 2001 while its GDP grew by 0.8%; its electricity grew by 5.0% in 1991 and its GDP dropped by 0.2%. Japan had a smaller electricity consumption by 1.3% in 2003 and its GDP grew by 1.8%, and had similar experience in 1980, 1982 and 2001. Japan s electricity grew in 1998 and 1999 while its GDP went down. Korea consumed 5.4% more energy in 1980 while its GDP dropped by 1.5%. Q: The report of this international agency introduced the views of a private firm that questioned China s GDP data due to the inconsistency between 1Q09 6.1% economic growth and some 20% trade decline. What do you think of it? A: Both figures are correct but to compare the two incomparable correct figures is not correct. The GDP growth is the composite results of investment, consumption and foreign demand. It is normal that one of the three, for example, the foreign demand, had a different growth. When one of the demands has declined but the other two have had greater growth rates, the GDP may grow. Moreover, the foreign trade, in the case of China, did not include services trade, and was not the entire foreign demand in a sense. When making analysis, we shall try to avoid such mistakes as the blind men and the elephant. The 6.1% GDP growth in the first quarter was achieved entirely owe to the stronger domestic demand. With the global financial crisis expanding, the world economy sharply declining and foreign and domestic demands weakening, China took a stimulus package aimed at expanding domestic demand and making a steady and rapid economic growth. Progress has been made with results that the investment had an increasing growth, consumption had a steady and fast growth and domestic demand made a greater contribution to the economic growth. Our preliminary estimates for the first quarter show that the investment and consumption contributed to 6.3 percentage points for the economic growth even though the foreign demand made minus 0.2 percentage point. Q: Do you have anything further? A: The international users have long trusted the information released by international agencies, and this will require the international agencies to take a careful, serious and responsible attitude when releasing the information in order to maintain a healthy and orderly development of the world. It is especially true when the global financial crisis is still here today. |

Related News

Photos

More>>trade

- Sales Price of Residential Buildings in 70 Large and Medium-Sized Cities in

- Administrator Xiao Jie Wrote an Article to Stress: Make Great Efforts to Provide

- Xiao Jie Talks with Young Cadres of SAT

- More than 1,100 Pirated Optical Discs Seized at Airport (with photo)

- The Area of International Pavilion of the Canton Fair Doubled and High-Quality

market

- Guangzhou Customs Stationed at China International Small and Medium Enterprises

- Guangzhou Customs Stationed at the Guangzhou Fair for the First Time to Provide

- The Logistic Expressway between Guangzhou and Hong Kong Opened and Cross-Border

- Guangzhou Customs Intercepted and Captured Smuggled Gen-seng over 1 Ton

- Guangzhou Customs Solved 4 Drug-Smuggling Cases One after Another through Postal

finance

- Guangzhou Baiyun Airport Customs House Intercepted and Captured 480 Watches

- Guangzhou Customs Built a Customs Clearance Express Way 1000 Motor Vehicles

- Guangzhou Customs New Office Building Opens Today First Floor Services Hall

- Intercept and capture the Air-yacht in the Pearl River estuary valiantly

- Guangzhou Customs Intercepted and Captured Imported Rubbish